In this guide, we’ll show you the three ways receipts from Receipt AI can appear in QuickBooks Online — from simple attachments to fully itemized expenses. Use the quick links below to jump to the section you need:

1. Receipt as an Attachment Only

The most basic setup is when a receipt is sent into QuickBooks Online through Receipt AI but isn’t automatically turned into an expense transaction. Instead, it shows up simply as a stored attachment (PDF, JPG, PNG, etc) inside QuickBooks.

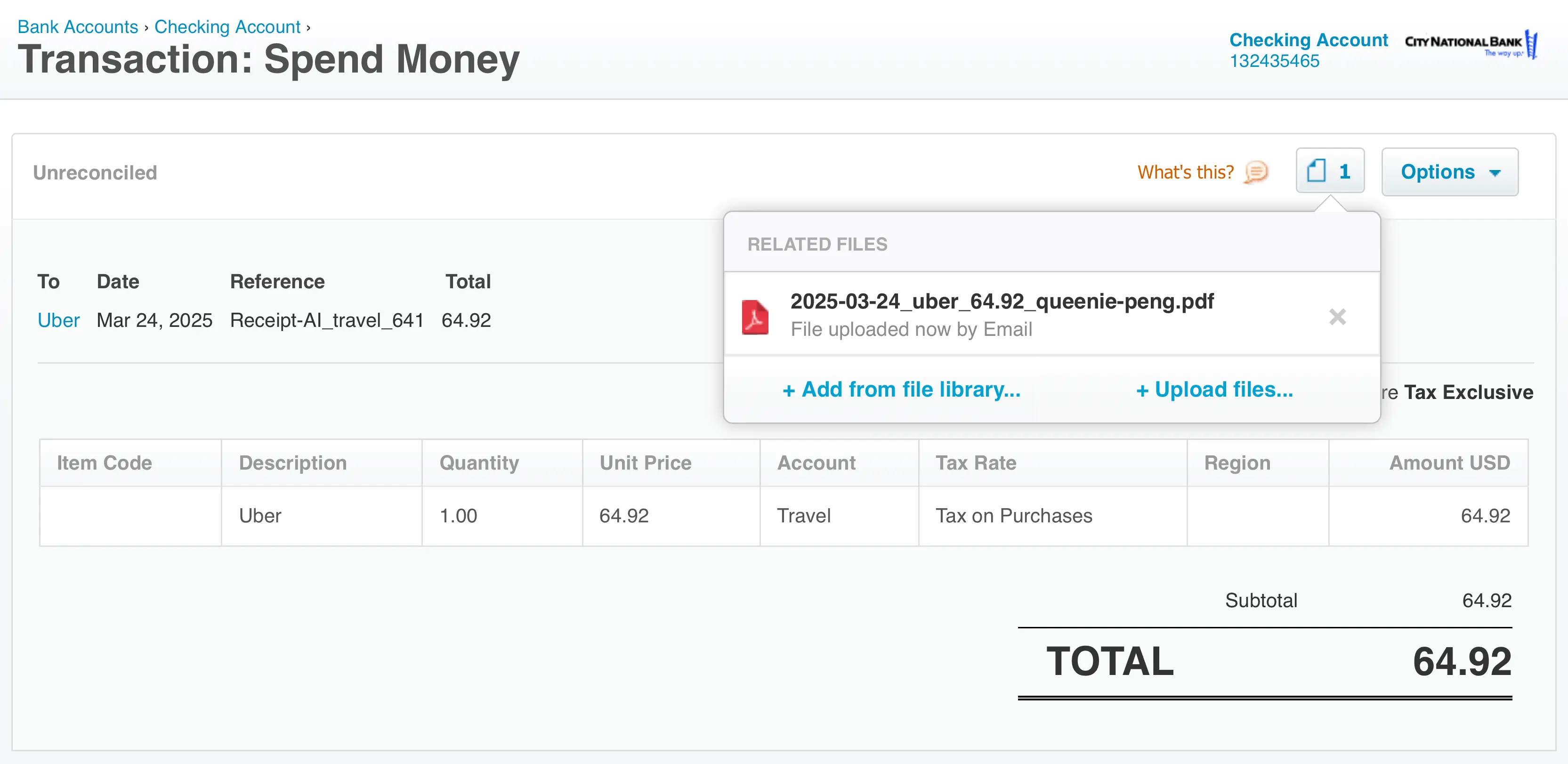

How it looks

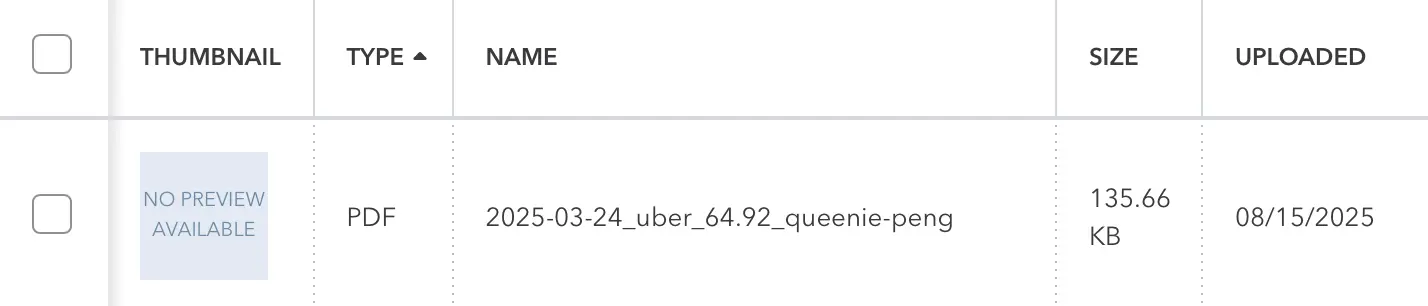

The uploaded file (for example, 2025-03-24_uber_64.92_queenie-peng.pdf) will be available in QuickBooks under the attachments section. No expense entry is created — just the receipt itself.

Why it’s useful

- Compliance and audits: Businesses that primarily need receipts kept in QuickBooks for audit purposes can use this method.

- Flexibility: Teams can later attach the document to a bill, match it to a bank feed transaction, or keep it as record-only.

- Control: For companies that don’t want every uploaded receipt to become an expense automatically, this is the cleanest option.

How to enable in Receipt AI

- Connect Receipt AI to your QuickBooks Online account.

- Do not enable One-Click Reconciliation.

- Leave Line Item in Accounting Software disabled.

- With these options off, receipts will flow into QuickBooks only as attachments.

This mode is perfect for businesses that want control over how receipts are eventually used, without forcing them into the expense workflow right away.

Try Receipt AI with QuickBooks

See your receipts appear in QuickBooks with line items automatically extracted by AI. Match transactions to your bank feed with one click.

Start Free Trial2. Receipt Linked to an Expense

The next level is when a receipt uploaded through Receipt AI is not just stored in QuickBooks but also automatically linked to a new expense transaction. This ensures the expense is recorded in your books at the same time the receipt is saved.

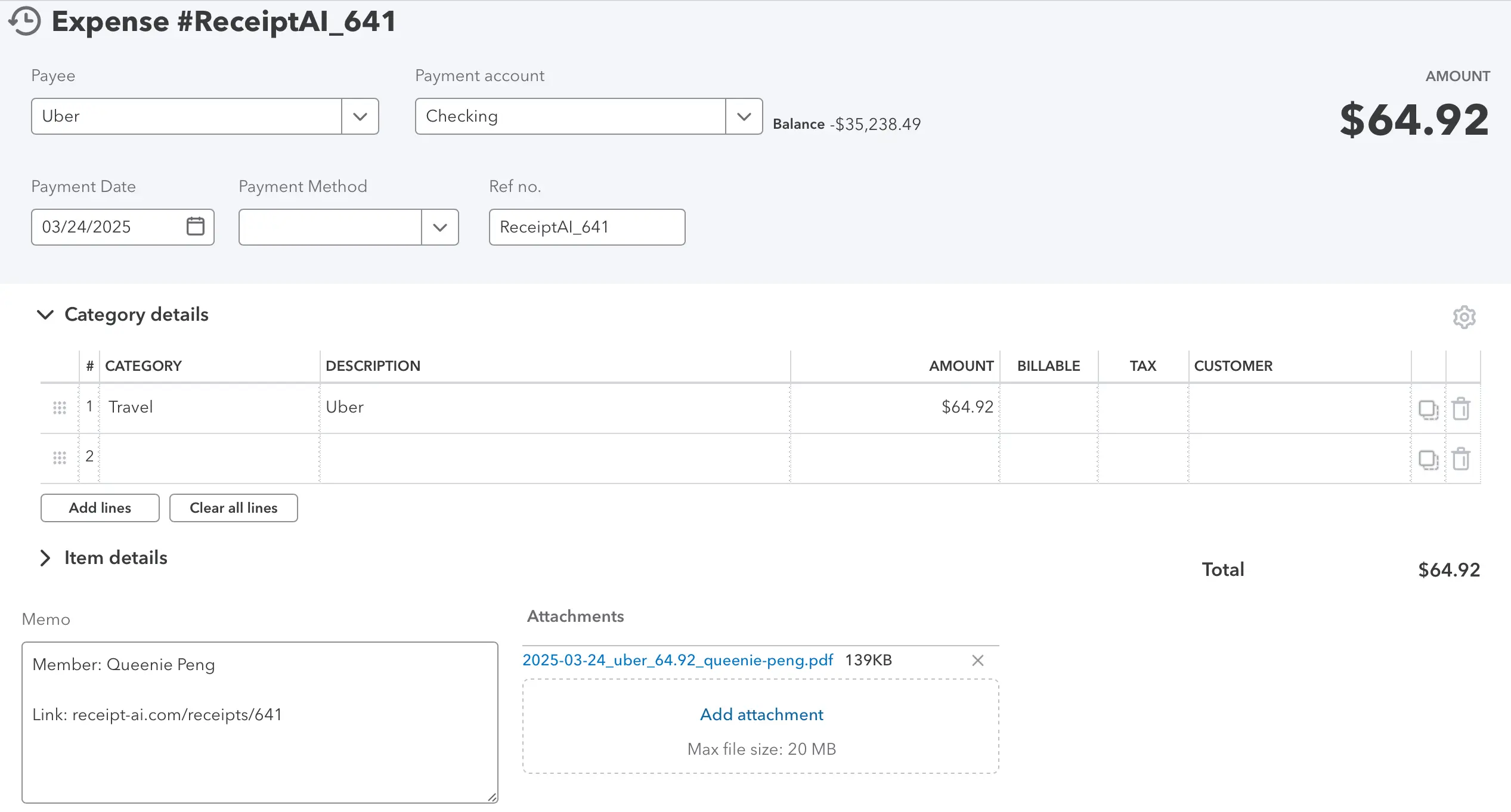

How it looks

In QuickBooks, you’ll see an expense entry (for example, Payee: Uber, Amount: $64.92, Category: Travel) with the receipt PDF attached. The memo may also include the employee’s name (e.g., Queenie Peng) and a link back to the Receipt AI record.

Why it’s useful

- Automation: Keeps receipts and expenses automatically tied together, reducing manual work.

- Accuracy: Ensures every transaction is properly documented with its supporting receipt.

- Efficiency: Makes it easier for teams to review expenses, bill clients, or prepare reports.

How to enable in Receipt AI

- Connect Receipt AI to your QuickBooks Online account.

- Enable One-Click Reconciliation

- Leave Line Item in Accounting Software disabled

- Set up your Chart of Accounts by linking members to the appropriate bank or card account

- Each processed receipt will then create an expense in QuickBooks with the receipt attached.

This mode is ideal for businesses that want receipts and expenses linked seamlessly, but don’t require line-by-line details.

3. Receipt Linked to an Expense with Line Item Details

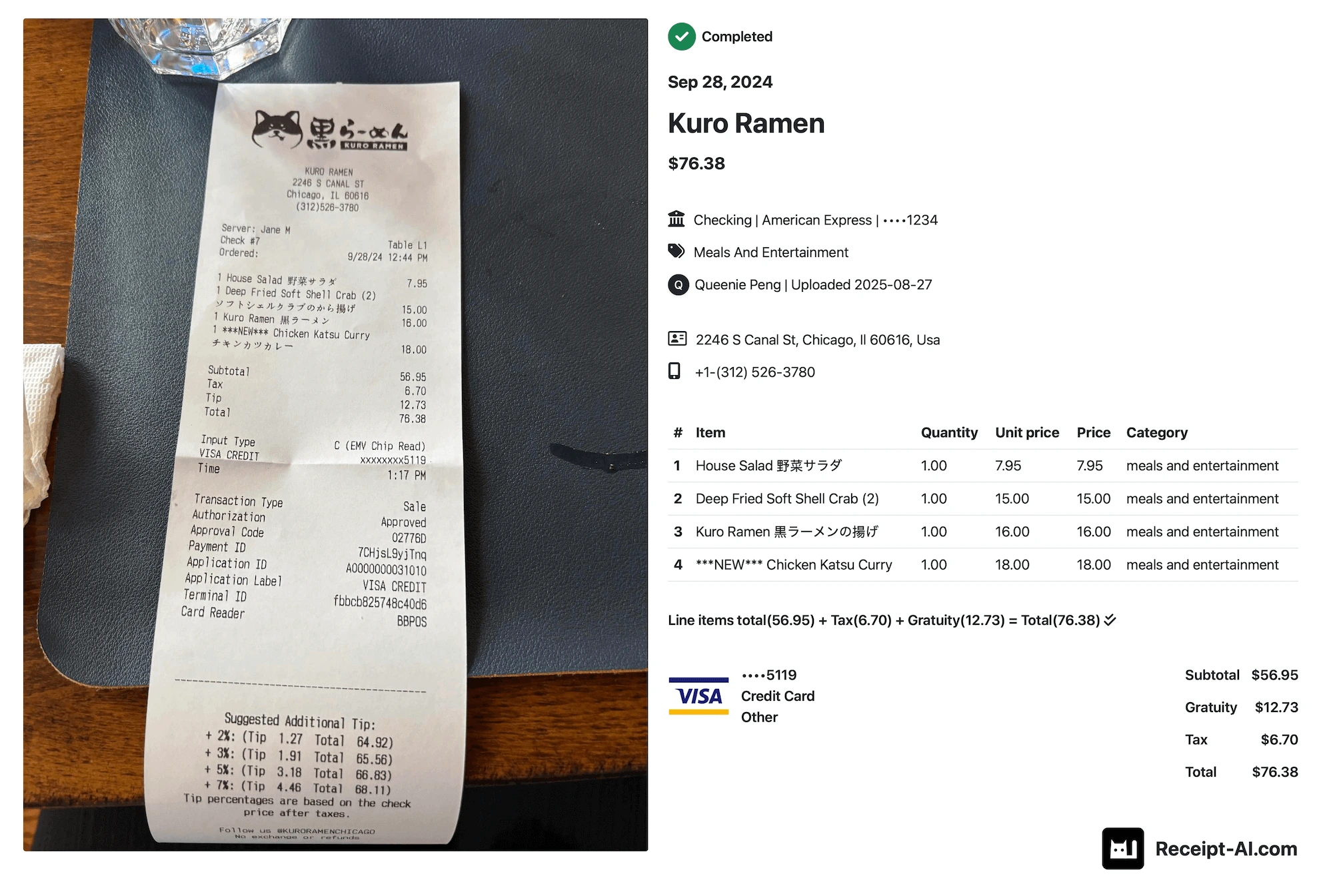

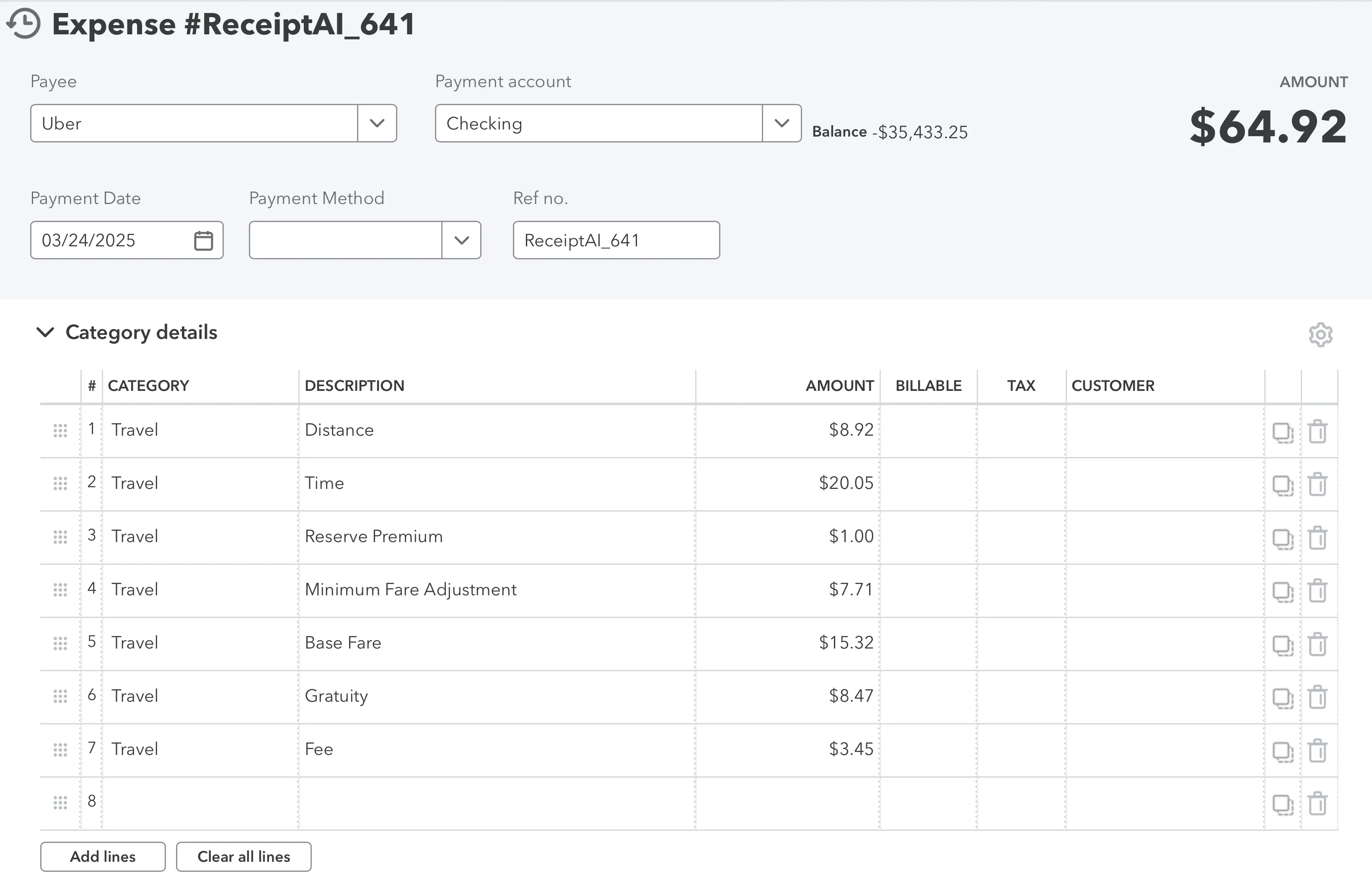

For businesses that need a detailed breakdown, Receipt AI can extract line items from receipts and sync them into QuickBooks as individual expense lines.

How it looks

In QuickBooks, instead of one Uber expense of $64.92, it’s split into:

- Distance: $8.92

- Time: $20.05

- Reserve Premium: $1.00

- Base Fare: $15.32

- Gratuity: $8.47

- Fee: $3.45

The original receipt PDF is still attached, but now the QuickBooks transaction reflects each component of the expense.

Why it’s useful

- Precision: Provides more accurate accounting by breaking out costs at the line level.

- Insights: Helps analyze spending patterns (e.g., gratuities vs. fares).

- Audit-ready: Improves reporting accuracy for businesses tracking detailed categories.

How to enable in Receipt AI

- Connect Receipt AI to your QuickBooks Online account.

- Turn on One-Click Reconciliation and Line Item in Accounting Software.

- Set up your Chart of Accounts in Receipt AI — the AI will categorize each line item automatically.

- Each processed receipt will then create a fully itemized expense in QuickBooks with the receipt attached.

This mode is best for businesses that want the highest level of detail, with AI ensuring each line is classified correctly.

Frequently Asked Questions about Receipt AI and QuickBooks Online

1. Does Receipt AI work with QuickBooks Online?

Yes. Receipt AI integrates with QuickBooks Online on the Business Basic plan and higher. Once connected, receipts can sync as attachments, expenses, or line items. You can switch between these formats anytime.

2. Why can’t I connect to QuickBooks on my current plan?

The Pro plan is for individuals and does not include accounting software sync. To use QuickBooks integration, you will need to upgrade to the Business Basic or higher plan from your dashboard → Edit Subscription.

3. How do I connect my QuickBooks Online account to Receipt AI?

After upgrading to the Business Basic plan or higher:

- Go to your Receipt AI dashboard.

- Click Connect to QuickBooks.

- Sign in with your QuickBooks account and follow the onboarding process.

Upload a receipt. Your receipt will then appear in QuickBooks in the format you selected.

4. Do edits to receipts automatically sync to QuickBooks Online?

Yes. Once a receipt has been synced (uploaded) to QuickBooks, any later edits in Receipt AI will automatically update in QuickBooks. A QuickBooks icon appears below each receipt once it’s synced.

5. Where can I find the receipt or expense created in QuickBooks Online?

Click the QuickBooks icon below each receipt to view it in QuickBooks Online. Sometimes it may take two clicks, as the first click might prompt you to sign in. You can also find all synced receipts under Attachments in your QuickBooks account.

Note: All three sync modes (attachments, expenses, and line items) can be changed easily at any time without re-uploading your receipts.

Learn more:

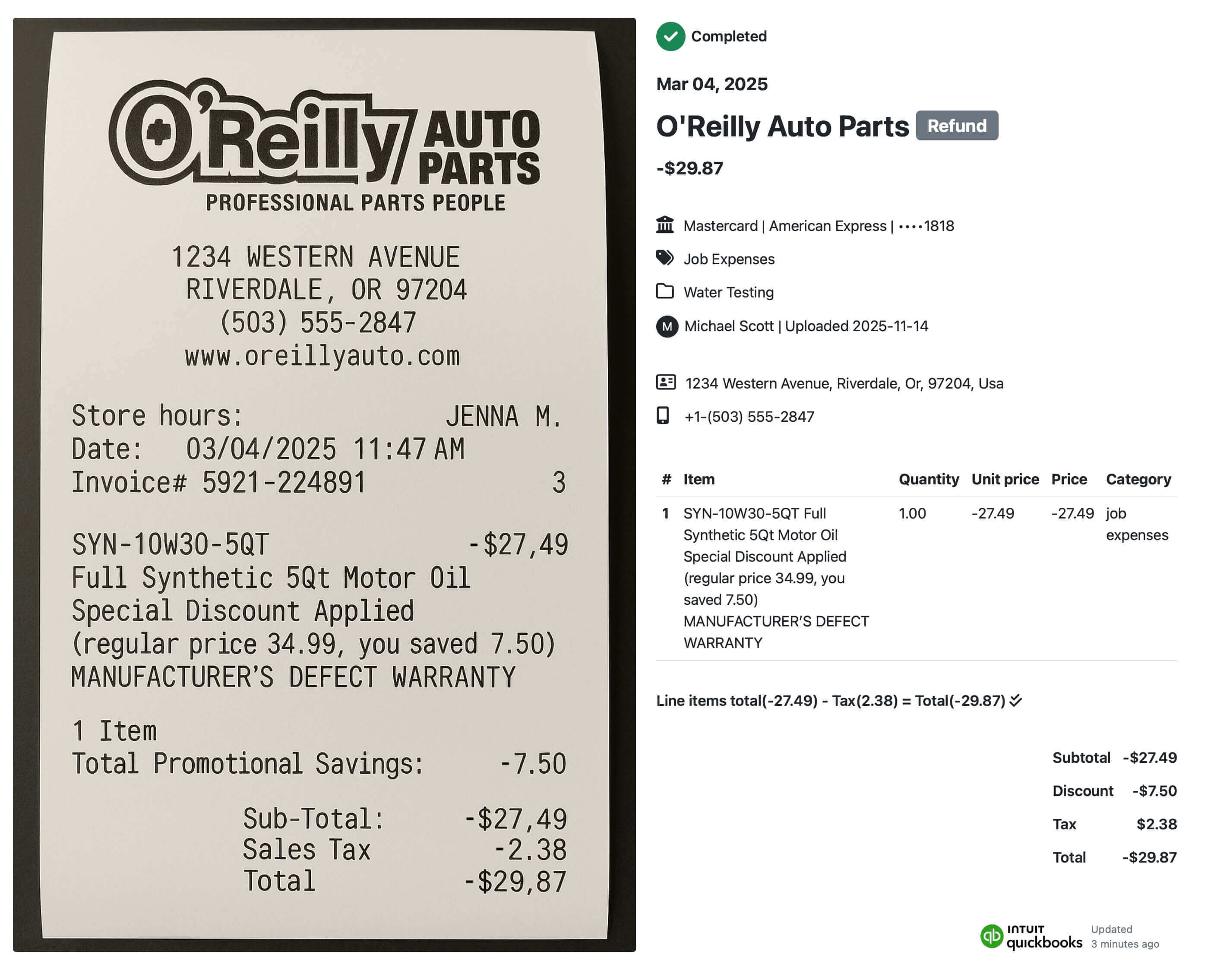

how Receipt AI automates refund receipts in QuickBooks

.