For business expenses, receipts are generally required to support deductions claimed on your tax returns. However, there are circumstances and specific expenses for which the Internal Revenue Service (IRS) may allow deductions without a physical receipt. It's crucial to note that while you may not need a receipt, some form of documentation or substantiation is usually necessary. Here are a few examples where deductions might be claimed without a traditional receipt:

1. Standard Mileage Rate

Instead of keeping receipts for gas, repairs, and other car expenses, businesses can use the standard mileage rate to calculate deductions for business use of a vehicle.

The standard mileage rates for 2025 are:

* Self-employed and business: 70 cents/mile

* Charities: 14 cents/mile

* Medical: 21 cents/mile

* Moving (military only): 21 cents/mile

Learn more from the IRS - "Standard mileage rates" [] and IRS News Release IR-2024-312 announcing the 2025 rates []

What methods can I use to compute the deduction for my vehicle expenses?

You can generally figure the amount of your deductible car expense by using one of two methods:

1. Standard mileage rate method.

2. Actual expense method.

IRS Topic No. 510 explains business use of a car and the two methods. If you use the standard mileage rate, keep a contemporaneous mileage log (date, destination, business purpose, and miles). If you use actual expenses, keep records/receipts for costs such as gas, oil, repairs, tires, insurance, registration fees, licenses, and depreciation (or lease payments).

Learn more from the IRS - "Topic No. 510, Business use of car"

[]

- Page Last Reviewed or Updated: 24-Sep-2025

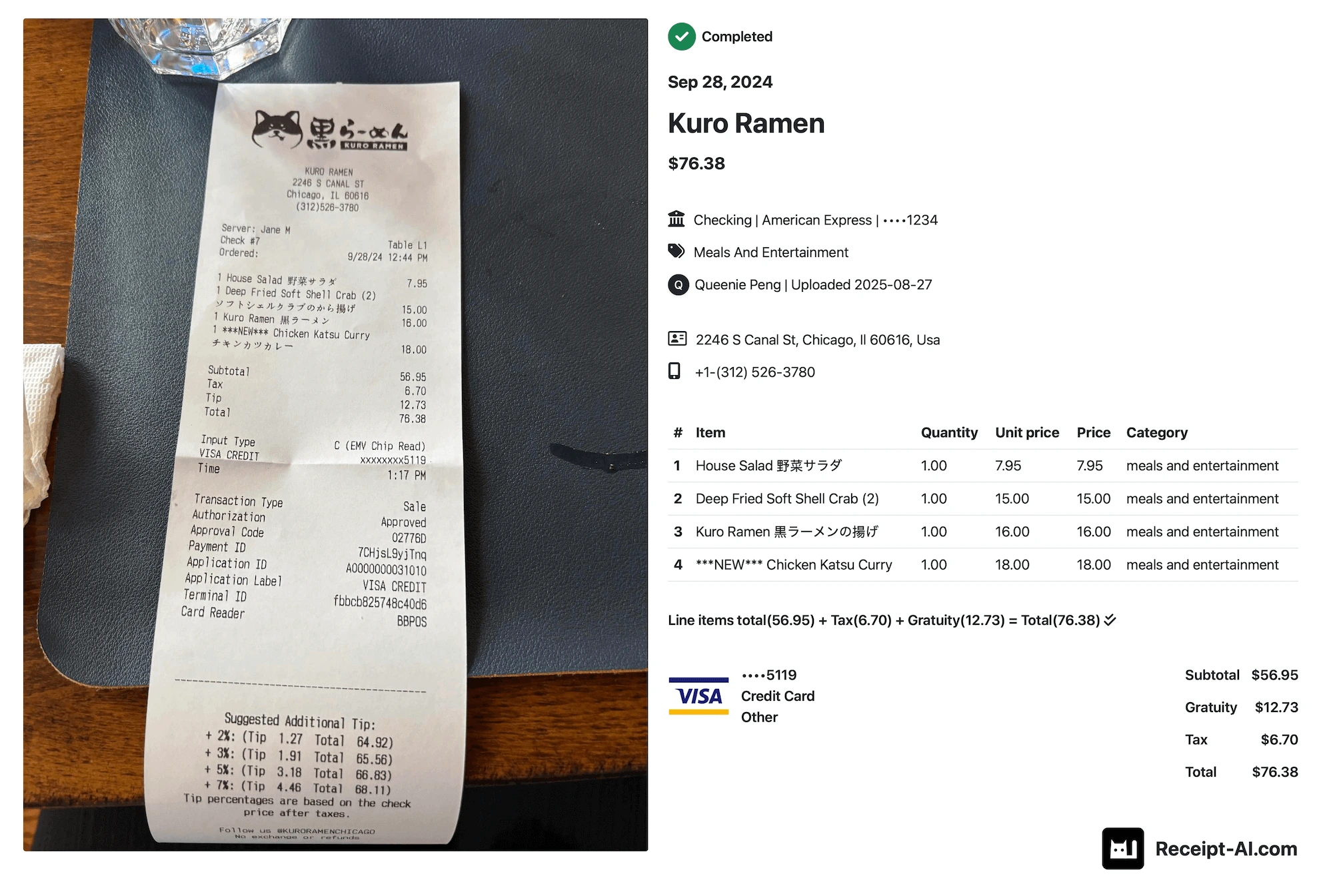

2. Meals and Entertainment (Business Meals)

The IRS states that the deduction for business meals is generally limited to 50% of the unreimbursed cost, and you must keep records that show the amount, date, place, business purpose, and business relationship of the person(s) entertained. A receipt is best practice; if one is missing, detailed contemporaneous records are essential.

Learn more from the IRS - "Topic No. 511, Business travel expenses" (includes meal rules)

[]

- Page Last Reviewed or Updated: 03-Oct-2025

"Publication 463, Travel, Gift, and Car Expenses"

[]

- Page Last Reviewed or Updated: 04-Mar-2025

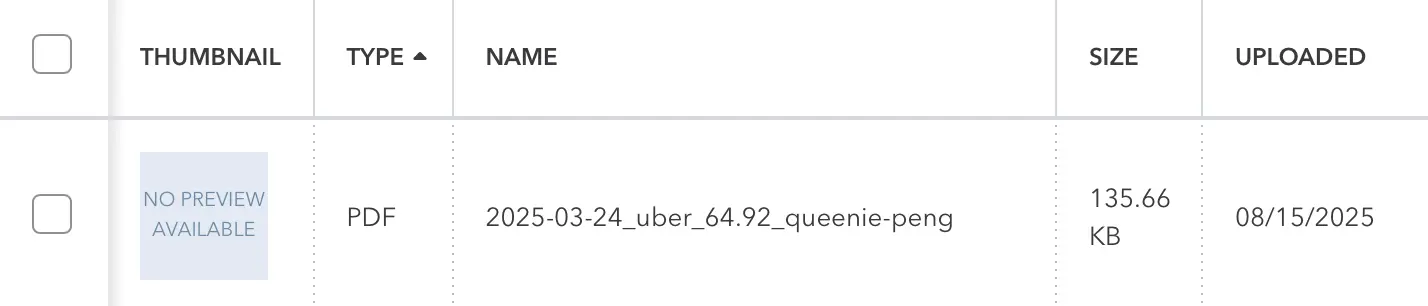

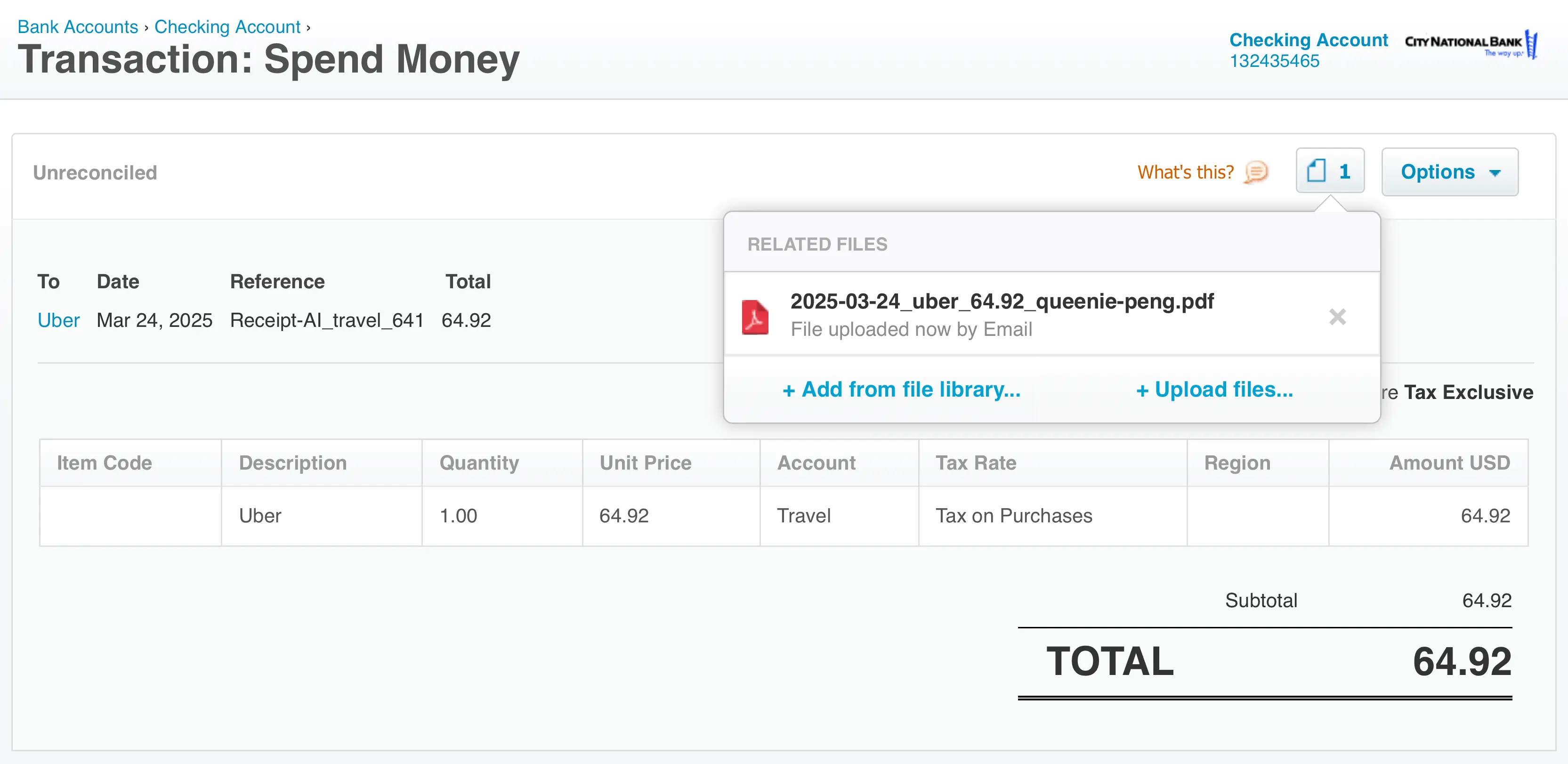

3. Travel Expenses

For business travel, you must substantiate the amount, time, place, and business purpose of your travel. Receipts are generally required for lodging. For meals and incidental expenses, the IRS allows a standard meal allowance (per diem) instead of actual receipts, subject to applicable limitations.

Learn more from the IRS - "Understanding business travel deductions"

[]

"Publication 463, Travel, Gift, and Car Expenses"

[]

Note: The most recent version of IRS Publication 463 (Travel, Gift, and Car Expenses) is the 2024 edition. As of October 2025, the IRS has not released a 2025 update. The 2024 publication remains the latest official guidance and continues to apply for the 2025 tax year unless a new version is issued.

4. What is the Standard Meal Allowance?

The IRS permits use of a standard meal allowance (meals & incidental expenses, or M&IE) for qualified business travel instead of deducting actual meal costs. The allowance is a set amount per day for the travel locality. You must still document the time, place, and business purpose of the travel.

Learn more from the IRS - "Publication 463, Travel, Gift, and Car Expenses" []

5. Small Purchases Under $75

According to IRS Publication 463, receipts are not required for certain business expenses under $75, except for lodging. You must still keep records showing the date, amount, and business purpose of the expense. This exception typically applies to tolls, parking fees, and local transportation costs.

Learn more from the IRS - "Publication 463, Travel, Gift, and Car Expenses" []

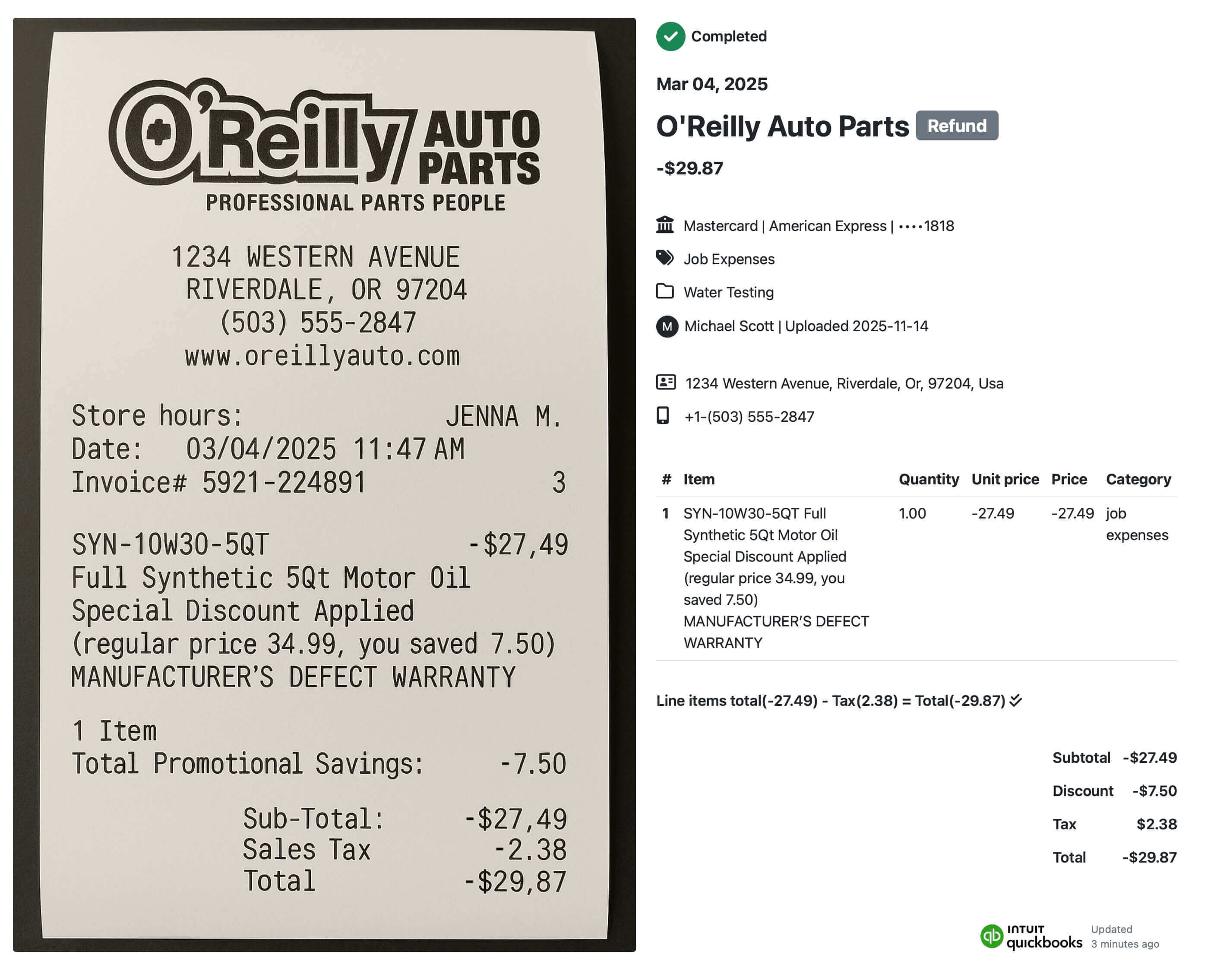

6. Business Supplies and Miscellaneous Expenses

Ordinary and necessary business expenses such as office supplies, software, and postage are deductible. If receipts are missing, you may use other documentation like invoices, canceled checks, or credit card statements as proof of purchase.

Learn more from the IRS - "Publication 535, Business Expenses" []

Note: The current edition of IRS Publication 535 (Business Expenses) is labeled 2022, but the IRS last reviewed and updated the publication’s online content on February 19, 2025. This means it remains the most current official guidance for the 2025 tax year until a new edition is released.

7. Utilities and Communication Costs

The business-use portion of utilities, internet, and phone services may be deductible. You do not need receipts for each bill if you can show payment records and a reasonable basis for your business-use percentage. Keep statements or summaries showing consistent usage patterns.

Learn more from the IRS - "Publication 587, Business Use of Your Home"

[]

- Page Last Reviewed or Updated: 24-Dec-2024

8. Depreciation and Capital Expenses

Assets like computers, office furniture, or equipment can be deducted through depreciation or Section 179 expensing. You must keep records of the purchase price, date placed in service, and percentage of business use. Receipts are ideal, but invoices and digital purchase confirmations are acceptable substitutes.

Learn more from the IRS - "Publication 946, How to Depreciate Property"

[]

- Page Last Reviewed or Updated: 18-Mar-2025

9. Home Office Deduction

If you use a portion of your home exclusively and regularly for business, you may qualify for the home office deduction. The IRS offers a simplified option that avoids detailed allocation of household bills. Under this method, you deduct a standard amount based on the square footage used for business.

For the simplified option, the standard deduction is $5 per square foot up to a maximum of 300 square feet. When using the simplified option, there is no depreciation deduction for the home portion and no later depreciation recapture for those years. Itemized deductions like mortgage interest and real estate taxes may still be claimed in full on Schedule A.

Learn more from the IRS - "Simplified option for home office deduction"

[] and IRS FAQs on the simplified method

[]

- Page Last Reviewed or Updated: 30-Apr-2025

and "Topic No. 509, Business use of home"

[]

- Page Last Reviewed or Updated: 23-Sep-2025

10. Recordkeeping and Substantiation

The IRS requires all taxpayers to maintain records that clearly show income and expenses. Acceptable documentation may include bank statements, mileage logs, appointment calendars, and electronic receipts. While physical receipts are preferred, digital documentation is acceptable as long as it is accurate and accessible.

Learn more from the IRS - "Publication 583, Starting a Business and Keeping Records"

[]

- Page Last Reviewed or Updated: 04-Feb-2025

For more detailed information and additional guidance, see the IRS pages: "Standard mileage rates" [], "Topic No. 510, Business use of car" [], "Topic No. 511, Business travel expenses" [], "Publication 535, Business Expenses" [], "Publication 587, Business Use of Your Home" [], "Publication 946, How to Depreciate Property" [], "Simplified option for home office deduction" [], and "Publication 583, Starting a Business and Keeping Records" [].