Refund receipts are one of those annoying bookkeeping chores most people don’t think about—until a return or warranty credit hits your credit card. Suddenly you’re stuck figuring out how to record a negative amount in QuickBooks without messing up your books.

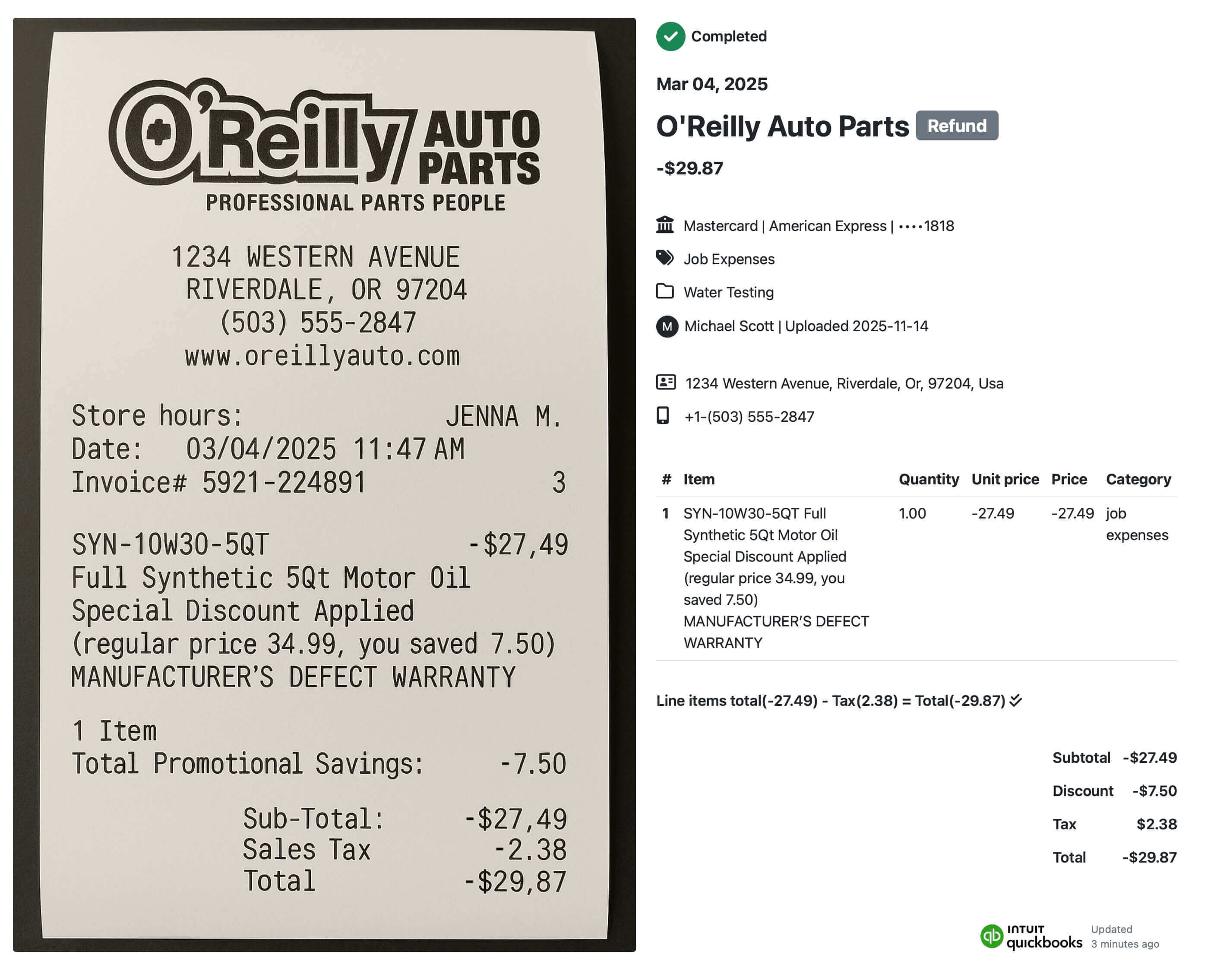

Receipt AI takes all of that off your plate. When you send it a refund receipt, it instantly recognizes that it isn’t a normal purchase. It extracts the details, formats the information correctly for QuickBooks, and records the right type of transaction based on your Chart of accounts—no manual edits, no guesswork.

Here’s how it works and why QuickBooks automatically creates a Credit Card Credit when money is returned to your card.

Recognizing a Refund Automatically (Without You Explaining Anything)

You don’t need to label anything or tell Receipt AI what happened. If the receipt shows money flowing back to you, Receipt AI automatically treats the document as a refund.

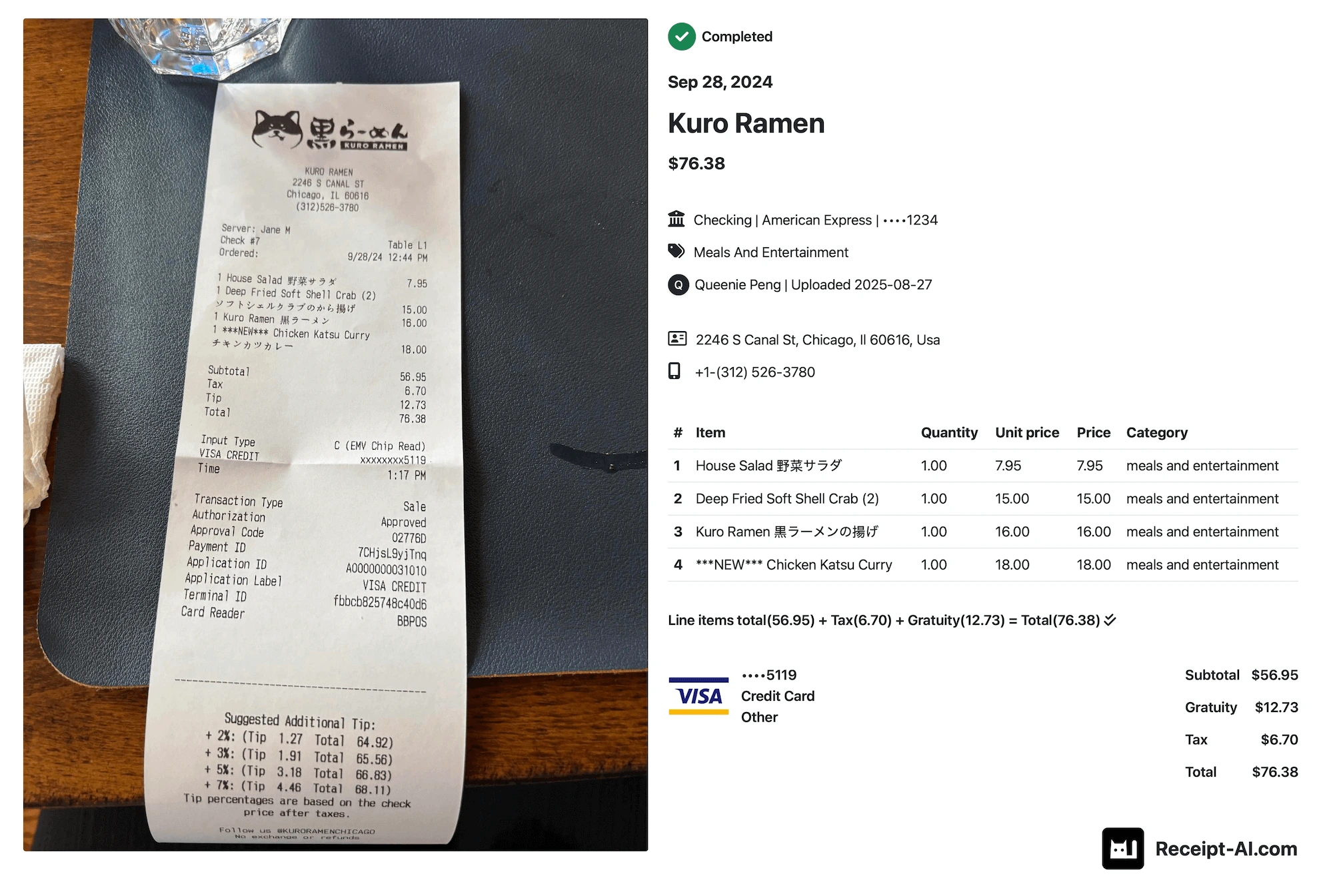

In the O’Reilly Auto Parts example:

- The amount is negative

- The vendor is recognized

- The payment method is detected

- The returned item is captured

- The correct category can be restored

Just email or text the receipt. Receipt AI extracts the details and syncs it to QuickBooks Online automatically.

From this single receipt, Receipt AI extracted:

- Vendor: O’Reilly Auto Parts

- Date: March 4, 2025

- Amount: –$29.87

- Category Applied: Job Expenses

- Item Returned: SYN-10W30-5QT Full Synthetic Motor Oil

- Tax Handling: Sales tax automatically reversed

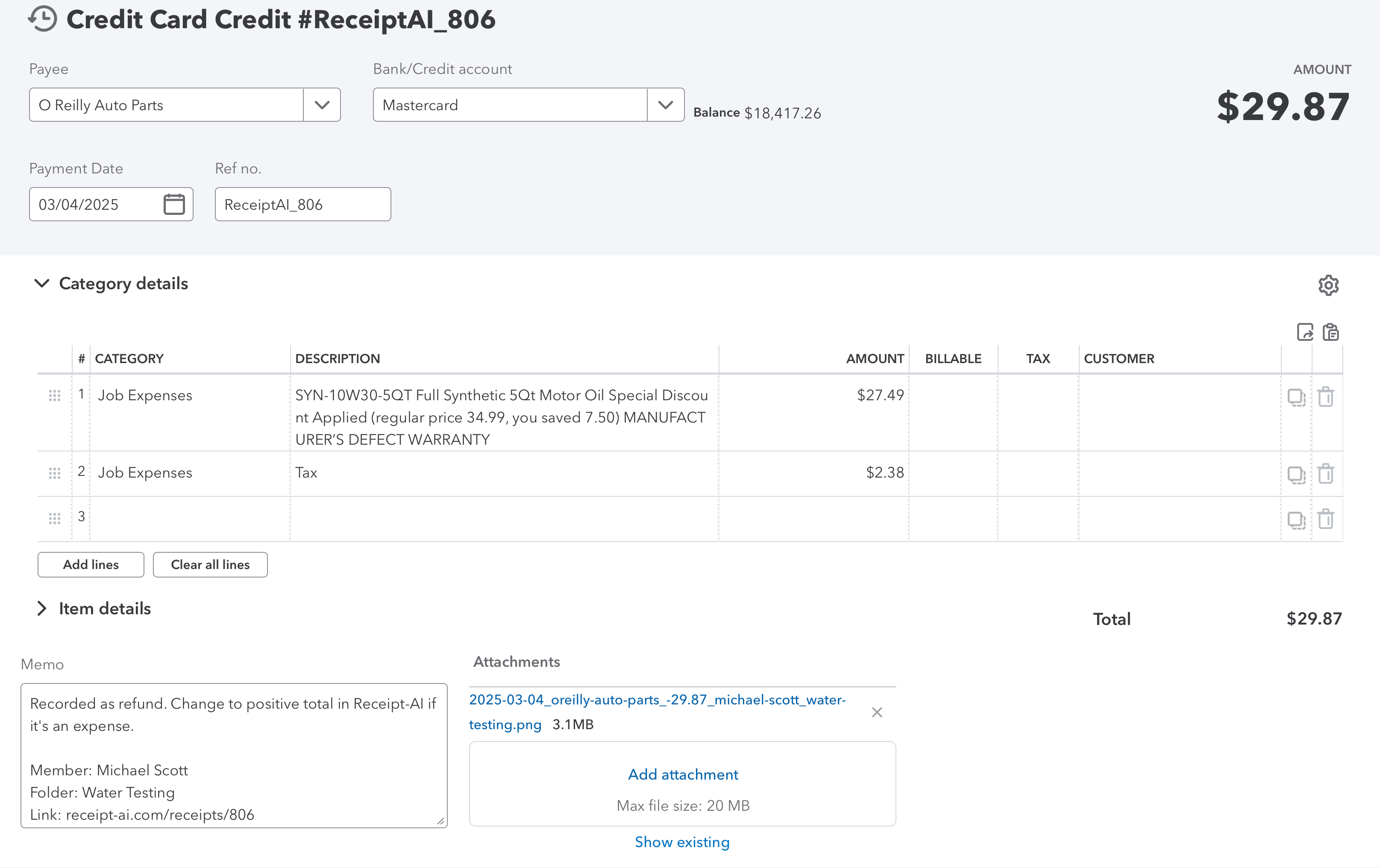

What the O’Reilly Refund Receipt Looks Like in QuickBooks (Credit Card Credit)

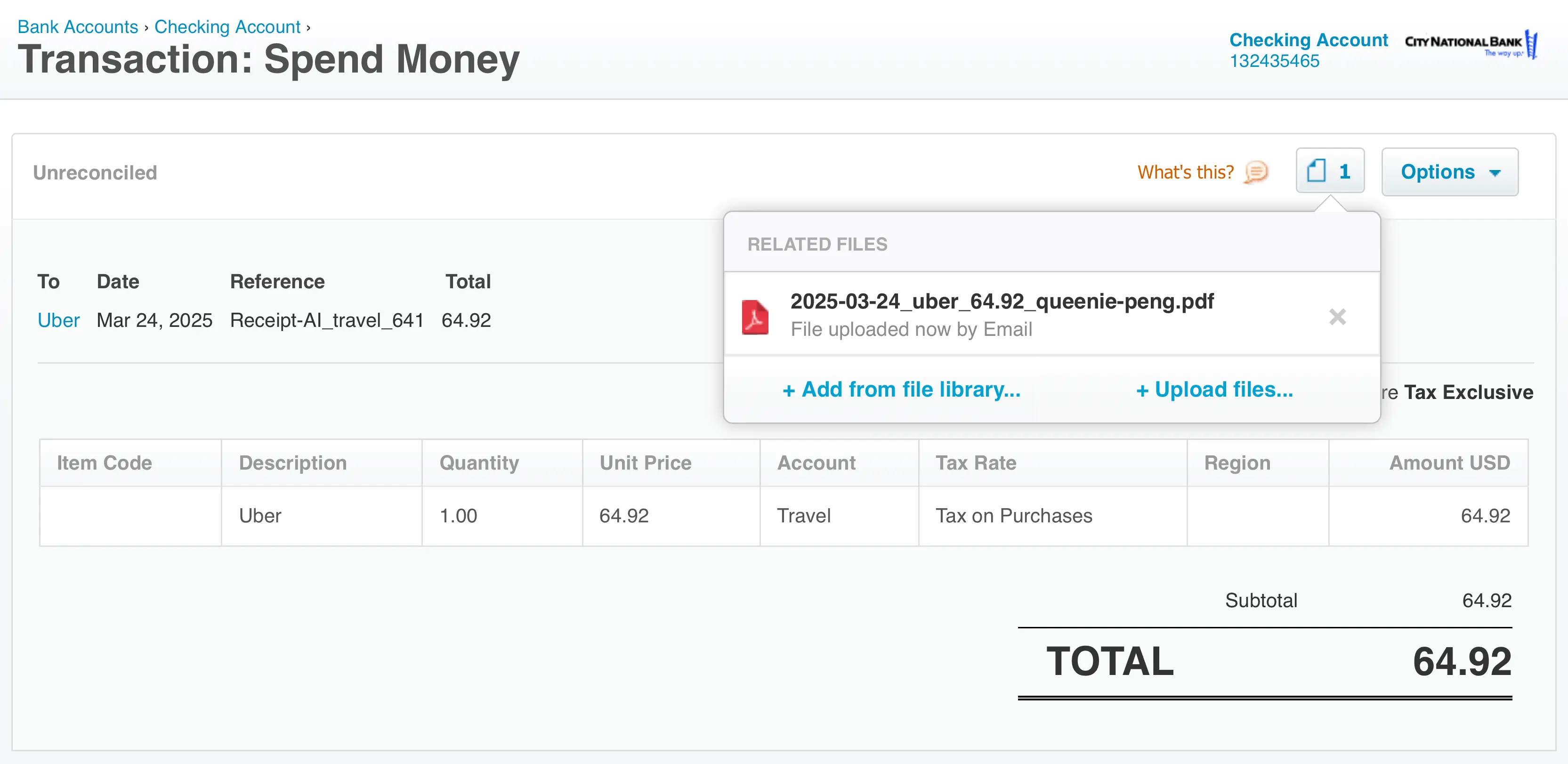

When Receipt AI syncs this refund to QuickBooks, it appears as a fully itemized Credit Card Credit. This is the correct QuickBooks transaction type whenever a purchase made on a credit card is refunded.

When the refund arrives in QuickBooks, Receipt AI has already created a complete Credit Card Credit for you. The vendor, date, payment method, refund total, and the returned motor oil item are all pre-filled and mapped to the correct category.

Receipt AI also attaches the refund receipt directly inside QuickBooks, making the transaction fully audit-ready with no extra steps.

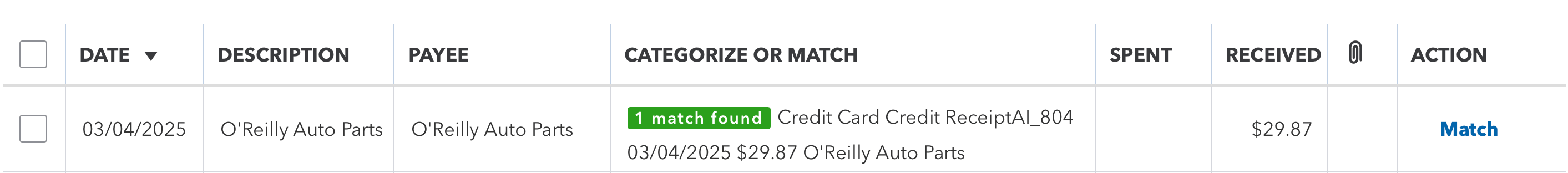

Reconcile the Refund in One Click (QuickBooks Bank Feed Match)

When the refund hits your credit card feed, QuickBooks automatically identifies a matching transaction created by Receipt AI. The vendor, date, and amount match perfectly, so QuickBooks recognizes the refund instantly.

Click Match to reconcile the credit card refund.

When the refund appears in your credit card feed, go to Accounting → Bank Transactions. QuickBooks will automatically suggest a match to the Credit Card Credit created by Receipt AI. Since all the details already line up—vendor, date, and amount—you can reconcile the refund instantly with a single click on “Match.

The refund is fully reconciled in seconds.

The Entire Refund Workflow — Hands-Free

No data entry.

No negative numbers to fix.

No uploading receipts.

No hunting for documentation.

Receipt AI identifies the refund, builds the correct QuickBooks transaction, attaches the receipt image, and ensures QuickBooks can match it instantly. You get a clean, accurate, audit-ready refund workflow with zero effort.

Frequently Asked Questions

Q: What if I accidentally upload a refund receipt as a purchase?

A: Easy fix. Just open the receipt in Receipt AI and change the total from negative to positive. Receipt AI will automatically sync it to QuickBooks as a purchase instead of a refund.

Q: Can I correct a purchase that was recorded as a refund?

A: Yes. Edit the total in Receipt AI and switch it from negative to positive. If you want to sync line items, change those as well. The sync will create a purchase transaction in QuickBooks instead of a Credit Card Credit.

Q: How does Receipt AI choose the category for refunds?

A: Receipt AI applies categories based on your chart of accounts. If Receipt AI has access to the original purchase, it can mirror the same category. If not, it uses the best-match classification. You can always adjust the category afterward in Receipt AI.

Q: What types of refund transactions does Receipt AI create in QuickBooks?

A: Receipt AI currently creates Credit Card Credit transactions only. Refunds returned to a credit card will sync correctly.

Q: Does Receipt AI attach the receipt image to the refund in QuickBooks?

A: Yes. Receipt AI uploads the receipt image and renames the file directly to the transaction in QuickBooks, giving you an audit-ready refund record and clean books.

Q: Will QuickBooks automatically match the refund in my bank feed?

A: Yes. When the vendor, amount, and date align, QuickBooks auto-matches the bank feed entry to the Credit Card Credit created by Receipt AI.

Q: What if QuickBooks doesn’t find the match?

A: If QuickBooks can’t automatically match the refund, it’s usually because one of the key details doesn’t line up — the date, vendor name, or total amount. Review the receipt inside Receipt AI and make sure these fields match what appears in your bank feed. If anything is off, simply edit the receipt in Receipt AI, and it will resync to QuickBooks with the corrected details so QuickBooks can match it properly.