Wednesday, March 13, 2024

What happens if you get audited and don’t have receipts?

Share this article:

Verify this is a real audit from the IRS:

If you are selected for an audit, the IRS will notify you by mail. The IRS will not initiate an audit by telephone.

Learn more from the IRS: "IRS Audits" []

If receipts are unavailable:

Gather alternative documentation:

Other forms of documentation can sometimes serve as substitutes. Bank and credit card statements, bills, invoices, canceled checks and any legal papers that can help rebuild the financial picture.

Detailed logs or diaries of business travels, mileage, and meetings can sometimes support deductions for business expenses.

Understand what records you need:

The auditors will inform you about the specific aspects of your return under review. Knowing whether the audit focuses on income, deductions, or credits will guide you in gathering the necessary documentation.

Consult a tax professional:

A tax attorney or certified public accountant (CPA) can provide valuable guidance through the audit process. Their expertise can help you understand your rights, prepare the necessary documentation, and represent you before the tax authorities if needed.

Potential Consequences:

Disallowed deductions:

If you cannot provide sufficient evidence to support claimed deductions, the tax authority may disallow them, leading to an increased tax liability.

Penalties and interest:

Beyond the additional taxes owed, failing to substantiate deductions can result in penalties and interest on the unpaid taxes.

Negotiation and settlement:

The auditor may be willing to negotiate or accept reasonable estimations in some cases, especially if you can demonstrate a consistent pattern of expenses or provide some form of documentation.

Best Practices for the Future:

Many taxpayers and business owners believe, 'The IRS is not going to target people like me,' until an audit notice appears in their mailbox. Receipts are crucial for verifying the accuracy of filed tax returns, providing proof of expenses, and documenting income.

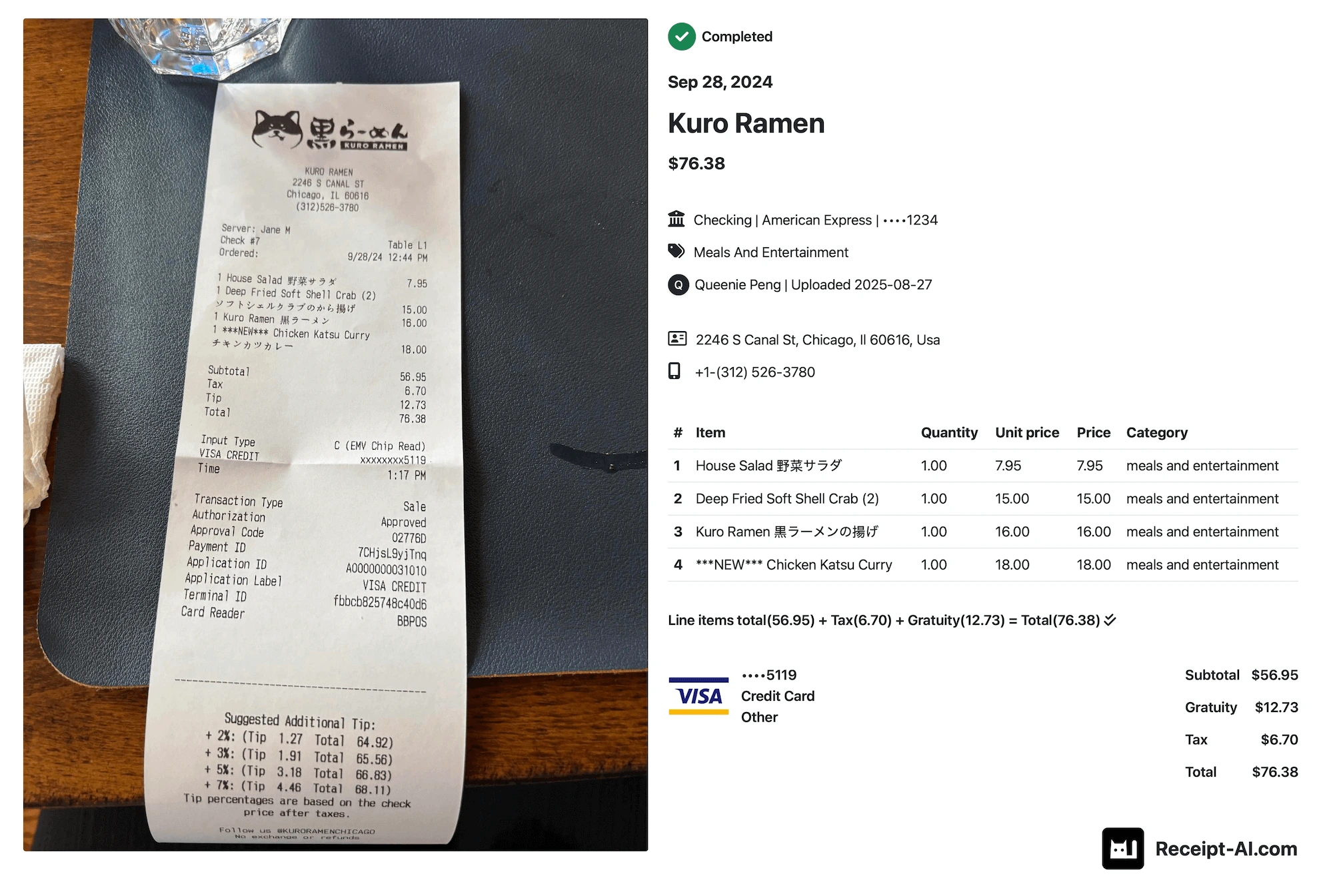

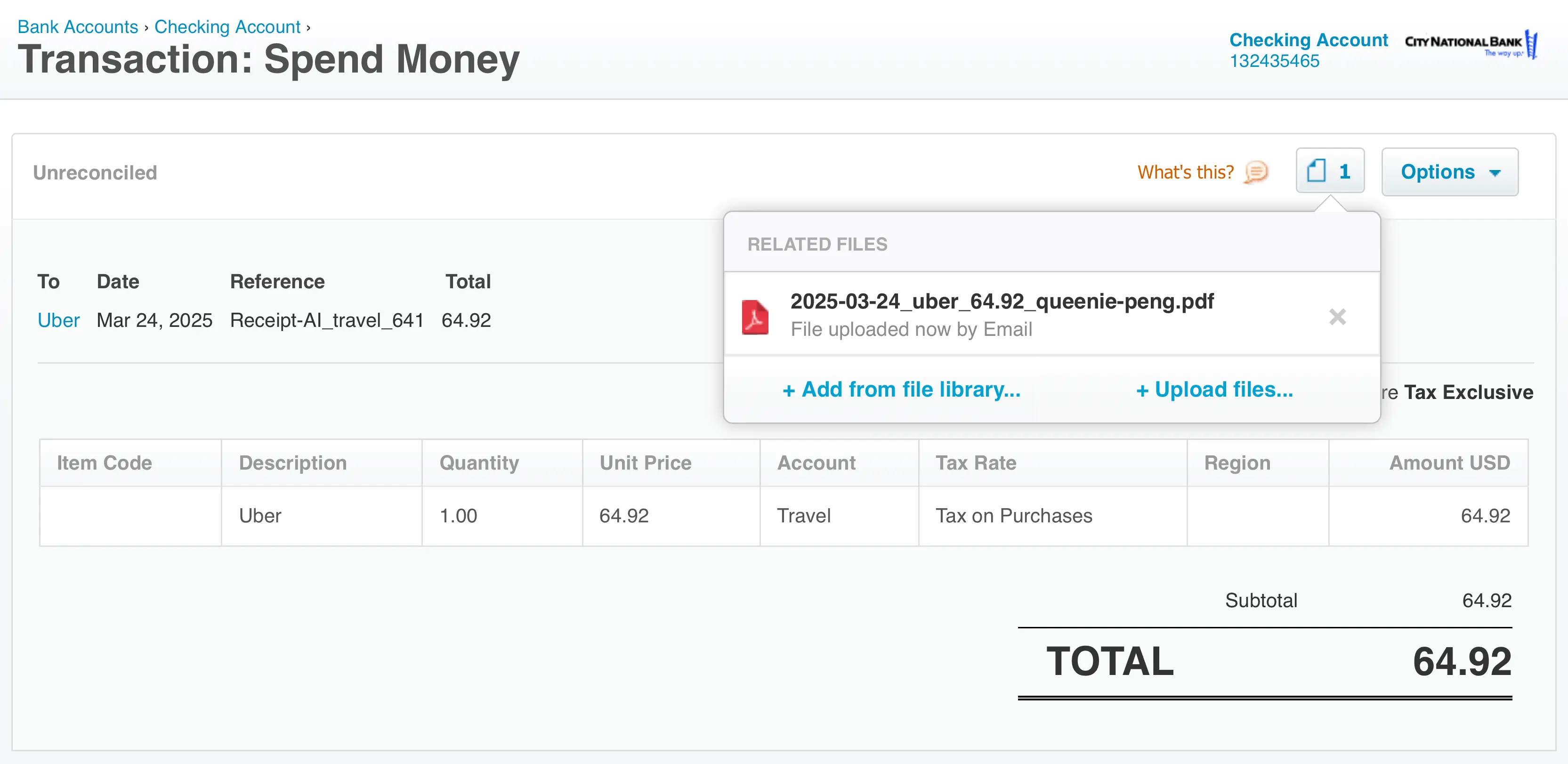

Prepare yourself with best practices using Receipt AI. Simply take a picture of a receipt, along with a message on what the receipt is for, and send it using SMS.

A Home Depot receipt uploaded using Receipt AI and SMS.

* What records do I need to provide?

The IRS will provide you with a written request for the specific documents they want to see.

Examples of records IRS might request:

Receipts – Present these by date with notes on what they were for and how the receipt relates to your business. In addition to providing the dollars paid or received for a service or product, certain kinds of receipts can prove mileage.

Bills – Include the name of the person or organization receiving payment, the type of service and the dates you paid them.

Canceled checks – Group these with copies of the bills they paid and any applicable employer reimbursement.

Other records, including legal papers, loan agreements, activity logs, tickets, medical records, loss documents, employment policies, and Schedule K-1 forms, are crucial for tax auditing.

* How far back can the IRS go to audit my return?

Generally, the IRS can include returns filed within the last three years in an audit. If they identify a substantial error, they may add additional years. They usually don't go back more than the last six years.

From Receipt AI:

We recommend keeping your records to at least 7 years just in case the auditor needs to examine an additional year. Once uploaded to Receipt AI, your receipts become easily searchable and accessible across multiple devices, making it easy to find the records you need.

Learn more from the IRS:

IRS Audits: Records We Might Request

https://www.irs.gov/businesses/small-businesses-self-employed/audits-records-request

IRS Audits: Q & A

https://www.irs.gov/businesses/small-businesses-self-employed/irs-audits

tax audit

tax audit representation

receipt scanner

receipts meaning

receipt ai