Monday, March 18, 2024

How Long Should You Keep Your Tax Records in Case of an Audit?

Share this article:

* You must keep records, such as receipts, canceled checks, and other documents that support an item of income, a deduction, or a credit appearing on a return as long as they may become material in the administration of any provision of the Internal Revenue Code, which generally will be until the period of limitations expires for that return.

Learn more from the IRS: "Topic no. 305, Recordkeeping" []

The Standard Rule: Three Years

The IRS generally advises taxpayers to keep records for three years from the date you filed your original return or two years from the date you paid the tax, whichever is later. This period, known as the "Period of Limitations," applies to the time frame in which you can amend your tax return to claim a credit or refund, or the IRS can assess additional tax.

Exceptions to the Rule

While the three-year rule covers many situations, there are exceptions where you'll need to keep your records for a longer period:

Four Years: If you have employees, you must keep all your employment tax records for at least 4 years after the tax becomes due or is paid, whichever is later.

Six Years: If you've understated your income by more than 25%, the IRS may go back six years for an audit. In such cases, retaining records for at least six years is advisable.

Seven Years: For taxpayers who file a claim for a loss from worthless securities or a bad debt deduction, keeping records for seven years is recommended.

Indefinitely: If you've filed a fraudulent return or haven't filed a return at all, the IRS advises keeping records indefinitely. There's no statute of limitations in these cases, meaning the IRS can initiate an audit at any time.

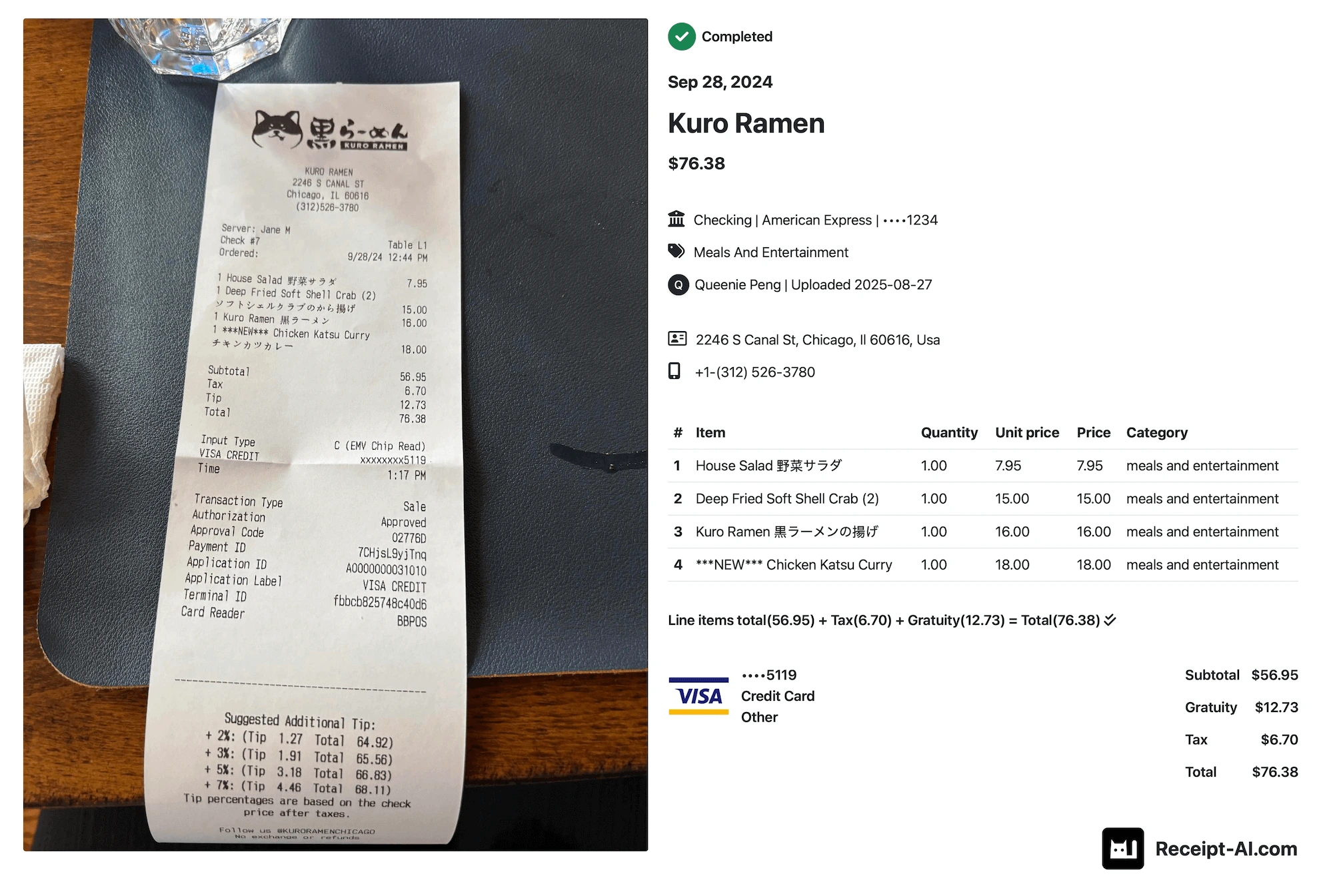

* Receipt AI simplifies collecting receipts through email and SMS, including paper receipts, emails, or those from coworkers.

What Records Should You Keep?

Understanding which documents to retain is crucial. Here's a brief overview:

Tax Returns: Keep copies of your filed tax returns. They serve as a guide for future returns and are helpful in amending previously filed returns.

Income Statements: W-2s, 1099s, and other forms that report income should be kept to verify the income you've reported.

Expense Records: Receipts, bills, canceled checks, and other proof of payment should be retained to support deductions or credits you claim.

Investment Records: Sale and purchase records for stocks, bonds, and other investments should be kept to calculate capital gains or losses.

Property Records: Retain records related to real estate or personal property for calculating depreciation, amortization, or gains or losses on sale.

Digital vs. Paper Records

In today's digital age, electronic records are as valid as paper ones. The IRS accepts digital copies, provided they are accurate reproductions of the original documents. Digital records can be easier to store and organize, but ensure they're backed up in a secure location.

Integrating Receipt AI into Your Tax Routine

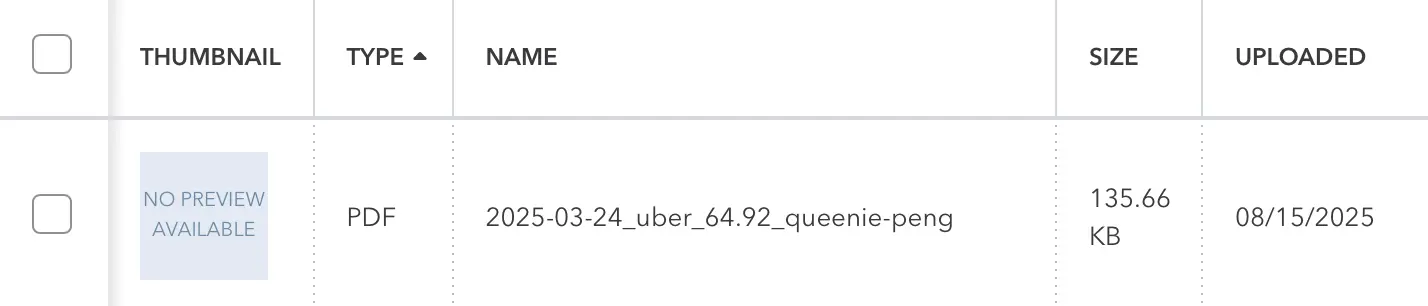

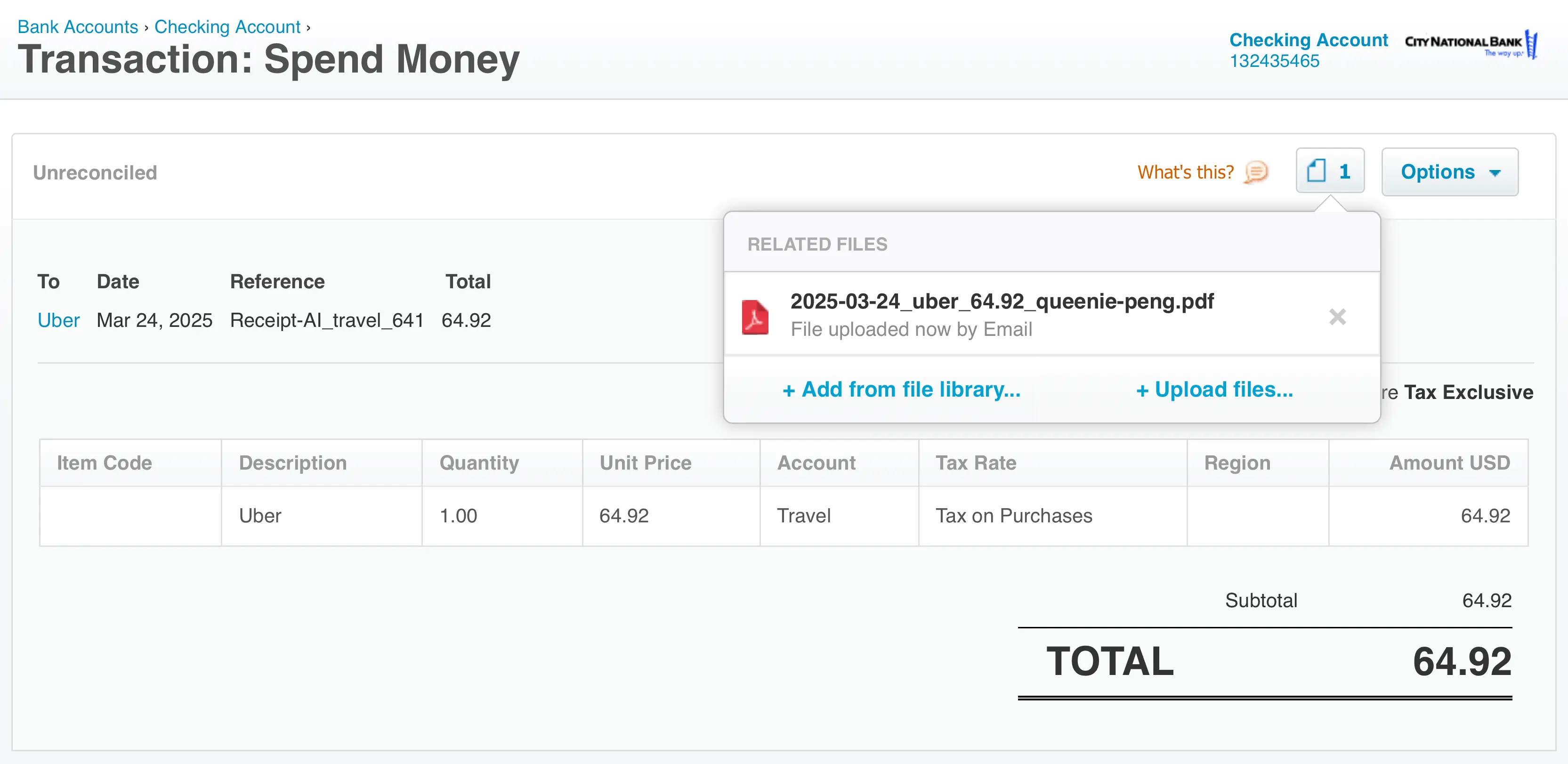

+ Simple upload: Simply take a picture and text. Receipt AI upload your receipts and invoices to Xero or QuickBooks using Email and SMS.

+ Automated Data Entry: Receipt AI eliminates the need to manually enter data from receipts and invoices, reducing the risk of human error.

+ Easy Organization: The software categorizes and stores documents, making it simple to retrieve them for tax purposes or in the event of an audit.

+ Secure Backup: With cloud storage options, Receipt AI ensures that your tax records like receipts and invoices are securely backed up and accessible from anywhere.

While keeping tax records might seem like a chore, it's an essential part of managing your financial health. Following the IRS guidelines, you can avoid potential headaches and ensure you're prepared in the unlikely event of an audit. Remember, when in doubt, it's generally wiser to keep your records a bit longer than necessary.

For more detailed information and additional guidance, you can refer to the IRS's pages on "How long should I keep records?" [], "Topic no. 305, Recordkeeping" [], and general "Recordkeeping" advice []. These resources offer insights into the importance of keeping well-organized records, which not only help in preparing your tax returns but also in supporting items reported on your returns.

tax audit

irs tax audit

what is a tax audit

tax audit definition

receipt ai